ULTIMATE MONEY MAKEOVER GAME PLAN

FREE GIFTS WITH ORDERS OVER $100 - Learn More

This product counts as one entry into our $1,000 CASH GIVEAWAY (1 Game Plan purchase = 1 entry)

The only guide you need to kickstart your journey to financial success.

This GAME PLAN contains 100+ pages of guidance, tools, worksheets and challenges designed to help you transform your relationship with money.

Our Ultimate Money Makeover Game Plan includes:

- 100+ page main ebook guide

+ BONUSES

- Monthly budget template

- Debt pay-off dashboard

- Net worth tracker

- Sinking funds tracker

- 30-day money mindset guided journal

- 17+ savings challenges

- Money goals planner

- Daily spending tracker

Not only will you receive the main guide that is filled with all the knowledge and guidance you need to kickstart your money makeover, but you will also receive a range of extra bonus tools (listed above) to make the whole process even easier.

Format: Digital download (all the PDF documents are fully editable so you can type straight into them or print them off if you prefer)

The link to download your Game Plan is included in your order confirmation email. Please check your junk/spam folders if you have not received this email immediately after purchasing.

Our Ultimate Money Makeover Game Plan covers the following topics:

- Money story

- Money mindset

- Goals

- Current financial position

- Bank accounts

- Budgeting

- Emergency fund

- Saving

- Income & expenses

- Debt

- Insurance & retirement

- Intro to investing

For more information on what’s covered in each chapter, scroll down to read the ‘What Will You Learn?’ section.

Get 50% OFF the 2025 Wealth Building Dashboard when you add the Ultimate Money Makeover Game Plan!

Choose options

UPGRADE TO OUR BEST-SELLING MONEY COMBO

ARE YOU READY TO:

WHAT WILL YOU LEARN?

MONEY STORY

- Think deeply about your relationship with money.

- Identify what is holding you back from a prosperous future.

- Re-write your future money story in a way that aligns with your goals and values.

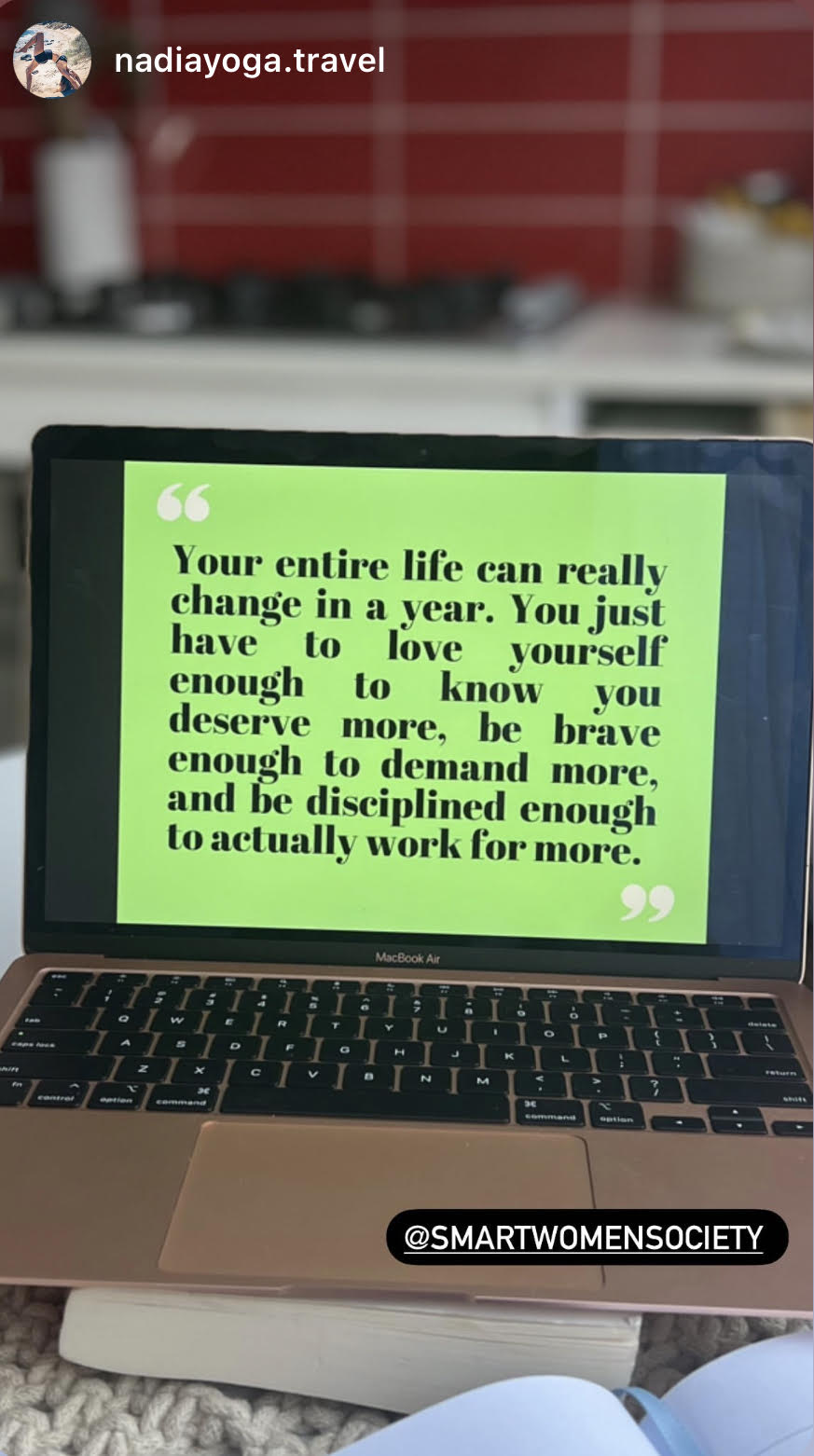

MONEY MINDSET

- Discuss why mindset is so important and how to improve yours.

- Identify the work that needs to happen behind the scenes to reap the rewards.

- Change your dialogue around money and eliminate your limiting beliefs.

- Understand that balance is key for long-term success.

GOALS

- Explore how to set and accomplish your financial goals.

- Set SMART goals.

- Learn how to break down big goals to make them more achievable and less overwhelming.

- Establish your current financial position and net worth.

- Take a look at your existing spending habits.

- Set up your bank accounts in a way that works for you.

- Understand how you can make ‘free’ money.

- Explore how automation can make your life stress-free.

- Make sure you always have money ready to pay your bills.

- Explore why budgeting is the key to getting ahead.

- Learn how to bounce back and move forward if you blow your budget.

- Understand the importance of tracking your spending and checking in with yourself regularly.

- Set a budget that works for YOU and accounts for saving, socialising and emergencies.

EMERGENCY FUND

- Explore what an emergency fund is, why you need one and how much you need in it.

- Break down the steps to creating your emergency fund.

- Identify when you should spend your emergency fund.

SAVING

Saving money does not have to be overwhelming. Let’s make it simple!

In this section, we will:

Organise your savings so you feel more connected to where your money is going.

Uncover tips and tricks to make saving fun, easy and a natural part of your daily life.

INCOME & EXPENSES

There are two main ways to have more money: increase your income or decrease your expenses.

In this section, we will:

Discuss how side hustles can help you achieve your financial goals faster.

Explain why lifestyle inflation is the worst thing you can do for your financial future.

Understand the importance of good money habits.

Discuss ways to cut your expenses and stop impulse buying.

Explore how your mood can lead to over-spending.

It’s time to break free from the shackles of your debt and create a plan to conquer it.

In this section, we will:

- Understand the difference between good and bad debt.

- Address debt shame and why you can’t let it hold you back.

- Discuss strategies to pay off your debt quickly.

Insurance and retirement are not the most exciting topics, but it is important to get on top of them early.

In this section we will:

- Discuss the main types of personal insurances.

- Break down the retirement schemes in both Australia and the US.

- Provide actionable tips to boost your retirement savings.

Understand the basic principles of investing and how you can use it to compound your wealth.

In this section, we will:

- Learn what investing is.

- Understand the difference between short-term and long-term investing.