5 Ways You Can Achieve Financial Independence

Achieving financial independence and being able to live comfortably without having to worry about money is a goal that most of us would like to achieve. However, the road to financial independence is not always easy. It takes a lot of hard work, dedication, and commitment to reach this goal. In this article, we will discuss five ways that you can achieve financial independence.

Start with a Clear Financial Plan

The first step in achieving financial independence is to start with a clear financial plan. This plan should outline your goals, your income, your expenses, your assets and your liabilities. It should also include a strategy for achieving your goals and a timeline for reaching them.

A clear financial plan will help you identify areas where you can cut back on expenses, as well as areas where you can increase your income. It will also help you stay focused on your goals and motivated to achieve them.

Build Multiple Streams of Income

Building multiple streams of income is another key strategy for achieving financial independence. Having more than one source of income can help you boost and diversify your income streams, whilst also reducing your reliance on a single source of income.

There are many ways to build multiple streams of income, such as starting a side hustle, investing in shares or real estate, or taking on freelance work. By building multiple streams of income, you can increase your earning potential and accelerate your journey to financial independence.

Minimise Your Expenses

One of the most effective ways to achieve financial independence is to minimise your expenses. This means cutting back on unnecessary expenses and living below your means. By minimising your expenses, you can increase your savings and investment rate.

Some ways to minimise your expenses include creating a budget and sticking to it, reducing your housing and transportation costs, and cutting back on discretionary spending. By minimising your expenses, you can free up more money to invest and accelerate your journey to financial independence.

Invest Wisely

Investing wisely is another important strategy for achieving financial independence. Investing allows you to generate passive income streams and grow your wealth over time thanks to the power of compound interest.

There are many different investment options available, such as stocks, bonds, real estate, and mutual funds. The key is to choose investments that align with your goals, time horizon and risk tolerance. By investing wisely, you can generate passive income streams that can help you achieve financial independence.

Focus on Long-Term Goals

Finally, it’s important to focus on long-term goals when pursuing financial independence. This means setting goals that will take years or even decades to achieve.

Long-term goals might include saving for retirement, paying off debt, or building a substantial investment portfolio. By focusing on long-term goals, you can stay motivated and committed to achieving financial independence, even when the journey gets tough.

|

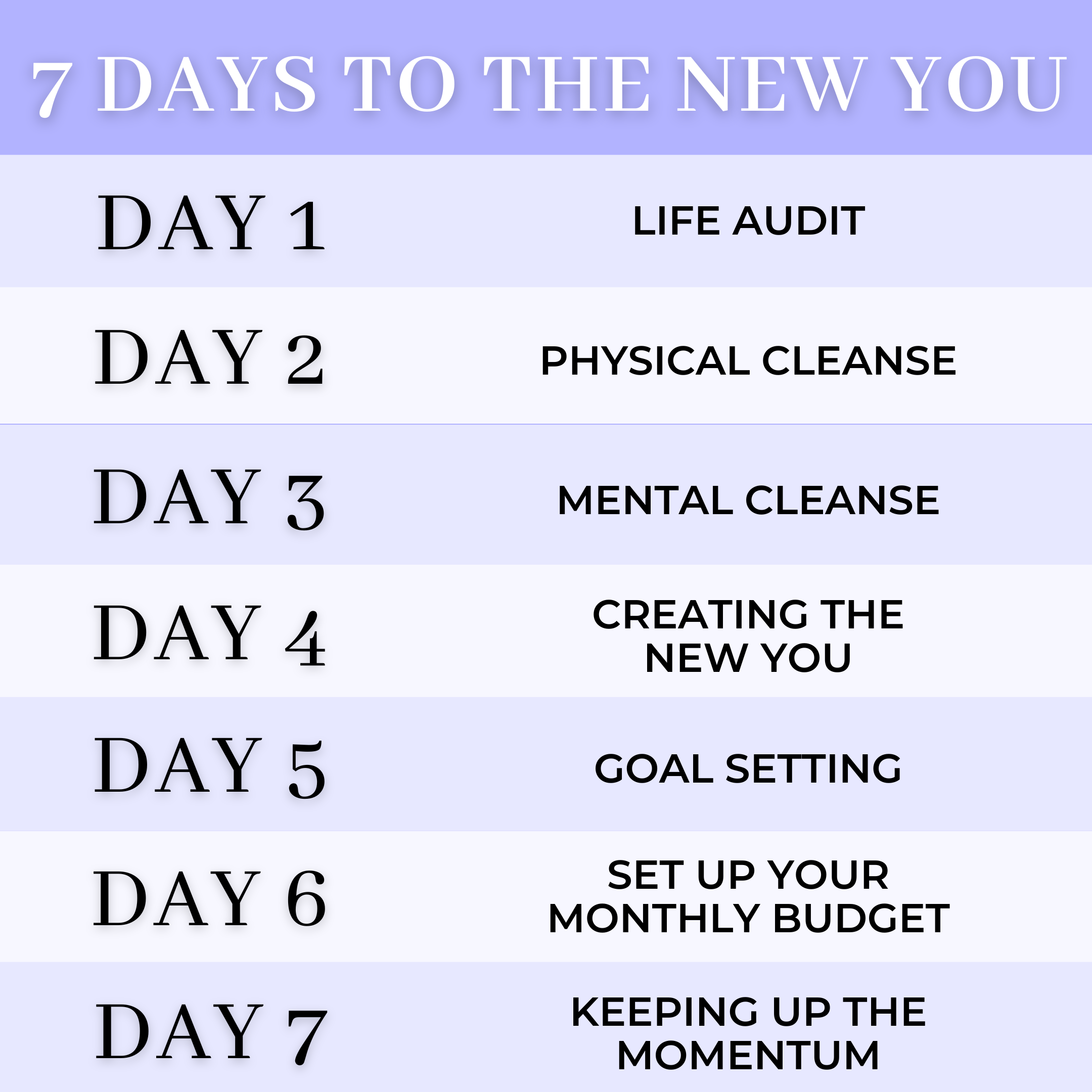

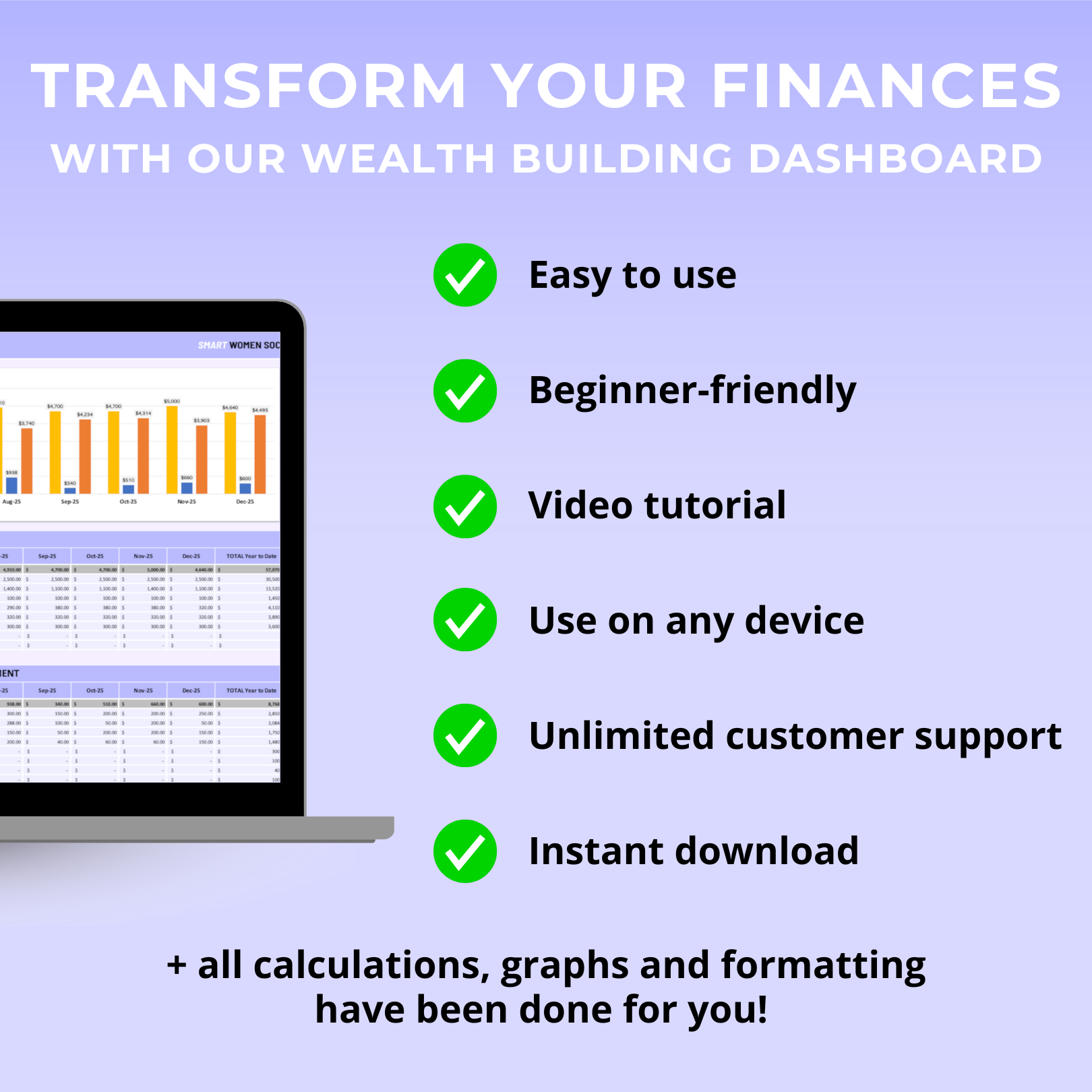

Grab our...Money Makeover ComboThe only guide you need to kickstart your journey to financial success.

|